synchrony lowes

lowe's synchrony payment

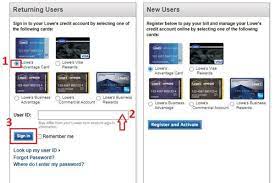

If you're a Lowe's shopper, you may be wondering if you can use Synchrony to make your payments. The short answer is yes! You may use Synchrony to make payments on your Lowe's account. To do so, simply log in to your Synchrony account and select Lowe's as the biller. Enter your Lowe's account number and the amount you'd like to pay. Your pay forment will be processed and applied to your account immediately. Synchrony is a superb way to manage your payments, because it offers many features that credit cards carry outn't. For example, you can set up programmed payments hence that you do not have to worry about missing a payment. You can also track your spending and see how much money you have available to spend each month.