lowes setpay login

synchrony lowes account

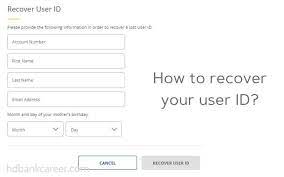

Synchrony is a financial services company that provides retail financing. Lowe's has partnered with Synchrony to provide funding options for shoppers. There are several benefits to having a synchrony lowes account, including distinctive discounts and promotions, special financing options, and more. To get started, simply apply for a synchrony lowes bank account online or in-store. Once you're approved, you can take advantage of all the benefits the program provides to offer. So if you're buying little extra savings on the next Lowe's purchase, make certain to consider a synchrony lowes account.If you're a Lowe's customer with a store credit card, you may be wondering what the best way is to make your payments. Synchrony Bank may be the company that issues Lowe's store credit cards, and they have a few different payment options available. The easiest way to pay your bill is online. Synchrony Bank has an online portal where you could sign in and manage your consideration. You may make one-time payments or setup automatic payments so you never have to worry about missing a due date. If you like to pay by mail, you can send your payment to: Synchrony Bank PO Box 960061 Orlando, FL 32896-0061. Make sure to include your account number on the check or money order so that your payment is applied correctly.

lowes setpay login