tjx rewards app

tjmaxx gift card

With a TJMaxx present card, you can shop from the comfort of your own home. You'll find all the same great deals on clothing, home goods, and even more, and never have to fight for a parking spot or stand in line. Plus, there's do not need worry about expiration dates or losing your card; simply add it to your web account and utilize it when you want. So next time you desire a last-minute gift for a holiday or birthday, skip the crowded mall and give instead the gift idea of TJMaxx. Friends and family and family will thank you-and so will your wallet.

tj maxx credit card fees

TJ Maxx is a retail store that offers a credit card with many benefits. However, there are also some fees associated with the TJ Maxx credit card. Here are some of the most common fees you might encounter: Annual Fee: You will be charged an total annual payment of $59 for using the TJ Maxx credit card. This cost is automatically charged to your account every year on the anniversary of when you first opened the account. Late Payment Fee: When you make a late payment on your TJ Maxx mastercard, you'll be charged a cost up to $38. This later payment fee is assessed by TJ Maxx and not because of your credit card company. Returned Payment Fee: If you make a payment that is returned from your bank or lender, you will be charged a came back payment fee as high as $27.

tj maxx payment options

TJ Maxx offers many payment options to make shopping convenient for customers. They accept cash, checks, money orders, debit cards, and all major charge cards. TJ Maxx also offers gift idea e-gift and cards cards that can be used online or in store. For online purchases, customers can choose to pay with PayPal, TJX Rewards® VISA OR MASTERCARD. VISA. MasterCard. American Express.

tj maxx payment methods

T.J. Maxx is a retail chain with over 4500 stores nationwide that offers shoppers low prices on brand-name apparel, home goods and more. While the store does not accept online orders, shoppers can use various methods to pay for their purchassera in-store. Debit and Credit cards are accepted by any means T.J. Maxx locations. Shoppers can also use cash or inspections, though personal checks are just accepted at certain storha sido. For customers who want to utilize a surprise card to pay for their purchase, T.J. Maxx accepts both physical surprise eGift and cards cards. To make things easier even, T.J. Maxx offers a store credit card that can be used to finance purchases or earn rewards points good for future shopping trips. Trying to get the T.J.

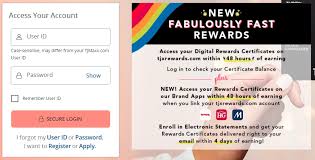

tjx rewards apptj maxx credit card late fee

If you're one of the millions of Americans who shop at TJ Maxx, you might be by using a TJX Rewards® bank card to save money. But did you know if you are late on the payment, you will be charged a $27 late fee? Some tips about what you need to know about the TJ Maxx credit card late fee: If you miss your payment deadline, you pays your repayment by one of the available methods still. Your payment is due by 5 p.m. ET on the due date printed on your account statement, or a overdue charge of $27 will apply. Your interest will also go up to 23.74% if you are late over a payment. You could avoid the later payment by making sure your payment is processed prior to the due date. You can do this by preparing computerized payments or paying online.

tj maxx credit card grace period

TJ Maxx is a popular store for people who want to find good deals on home and clothing goods. TJ Maxx credit cards are also becoming popular because they provide a grace period on purchases. The TJ Maxx charge card grace period is about 23 days usually. It's the time between the end of the last billing cycle and your deadline. In the event that you pay your credit greeting card invoice completely by the finish of your sophistication period, you will not be charged with interest for purchases. If cardholders do not pay back their balance within the grace period, they'll be recharged interest on their purchase.

tj maxx credit card annual fee

TJ Maxx is a store credit card that offers lots of advantages to its holders. One of these benefits is the annual fee. The gross annual charge for TJ Maxx charge cards is $0. And, of course, you don't necessarily have to settle for just one card. You could use the TJX Rewards® Platinum Mastercard® on TJX purchases and the Citi® Double Cash Card - 18 month BT offer everywhere else. There are plenty of other store bank cards that charge an total annual fee, but TJ Maxx will not. This makes it an ideal choice for people who wish to avoid paying payments for their credit card use.

What credit bureau does T.J. Maxx pull?

TransUnion is mostly used for approval of the TJX Store Card. That doesn't mean that when performing a hard pull on your credit report, it won't utilize Experian, Equifax, or any combination of them. But don't worry about it being random. All of these reports should show responsible credit use if you are.

Does TJ Maxx do a hard credit check?

TJXRewards/SYNCB might be on your credit file as a difficult inquiry. This usually happens when you apply for a TJX Rewards credit-based card or TJX Rewards Platinum Mastercard issued by Synchrony Bank. The TJX Rewards credit TJX and credit card Rewards Platinum Mastercard can be found at TJ Maxx stores

Does TJ Maxx credit card have a grace period?

The TJX Credit Card grace period is 23 days. It's the time between the end of the last billing cycle and your due date. If you pay your credit card expenses in full by the end of your grace period, you won't be charged with interest for purchases

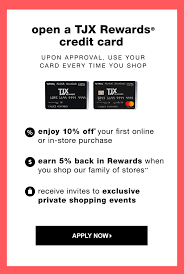

Does TJ Maxx give instant approval?

TJX / TJ Maxx Credit Card - If you apply for the credit card, it will be approved right away at TJ Maxx and its sibling stores Marshalls, HomeGoods, and Sierra. You will receive 10% off your first purchase with the card if you are promptly authorized.